Wealth Accumulation: Home Depot

Industry: Retail

Foundation: The Arthur M. Blank Family Foundation

Website: http://www.blankfoundation.org/

Passion drives Blank’s philanthropic giving. Arthur has openly stated while there are many issues in need of financial support, his foundation will invest in the areas that his family has “the most personal passion.” As evidenced above, this is primarily limited to charitable causes in the local Atlanta, GA region.

Wealth Accumulation: Davis & Rock; Hayden, Stone & Company

Industry:

Foundation:

Website:

Wealth Accumulation: Berkshire Hathaway

Industry:

Foundation: Alfred C. Munger Foundation

Website:

Sr. or Jr., library interest includes library science

Wealth Accumulation: Facebook

Industry: Technology

Foundation:

Website:

While Chris’ philanthropic giving is still in its nascent stages, he focuses his financial support on issues where his contributions will be the “most effective.” Over the past two years, this has become narrowly focused on direct cash transfers. He currently serves on the board of GiveDirectly, a nonprofit organization providing help to those living in extreme poverty through unconditional cash transfers via their cellphones. Aside from his philanthropic initiatives, Chris and his husband Sean have emerged as a significant force in political circles, becoming distinguished New York fundraisers for the progressive issues they support. Similar to Mayor Bloomberg, Chris recognizes the importance of private philanthropy to serve as a testing ground to cultivate effective programs that can later be scaled through public initiatives.

******** Previous Individual Net Worth **********

***************** 850,000,000 ****************

******************************************************

Wealth Accumulation: Walmart

Industry: Retail

Foundation: The Walton Family Foundation

Website: http://www.waltonfamilyfoundation.com

Outside of Alice Walton’s Crystal Bridges Museum of American Art in Bentonville, Arkansas, the Walton Family Foundation directs the majority of its spending to education reform where they are endeavoring to “infuse competitive pressure into America's K-12 education system." The Waltons are funding the education reform movement in two ways: through the Walton Family Foundation and through local-level political donations. Since 2000, members of the Walton family have spent at least $24 million funding politicians, political action committees and ballot issues at the state and local level that favor their approach to school reform. The political activities of the Walton family and Walmart frequently intertwine and reinforce each other, even when it comes to education reform.

Wealth Accumulation: Third Point LLC

Industry:

Foundation: The Daniel S. Loeb Family Third Point Foundation

Website:

• Through the Loeb Family’s Third Point Foundation, Daniel supports a variety of organizations with smaller donations, mostly focusing on arts and culture in New York, but also contributing to a wide range of health causes, and other select causes. • He is also a trustee at several non-profits, but donations to these organizations appear to be more private, so the scale of his giving is unclear. • Loeb has been an outspoken supporter of marriage equality and reproductive rights, supporting organizations such as Planned Parenthood and NARAL Pro-Choice, was a signatory on a brief to the Supreme Court in favor of same-sex marriage, and has also contributed to Media Matters. On some issues however, he appears less progressive, as a member of the National Council of the American Enterprise Institute and the Council on Foreign Relations.

Wealth Accumulation: Kaufman & Broad; Sun Life Insurance

Industry:

Foundation: Eli & Edythe Broad Foundation

Website: Broadfoundation.org/index.html

Eli describes his approach to philanthropy as entrepreneurial; however, other have described it as similar to negotiating a business deal "Eli does nothing without strings." It is not altruistic. It is not blind charity. Eli makes no apology for his exacting demands on how the millions he has donated are spent, nor the consequences for failure. He has been known to pull his financial support if results don't meet his initial expectations.

Wealth Accumulation: Newsweb Corporation

Industry: Media

Foundation: Alphawood Foundation

Website: http://alphawoodfoundation.org/

Fred consistently appears on the list of top U.S. political contributors; however, unlike his political contributions, which are publicly disclosed by law, his charitable donations are predicated largely on condition of anonymity. His Alphawood Foundation, which he initially intended to call “Anonymous,” contributes almost exclusively in Illinois. Its gifts often focus on providing restoration and operating funds to architecture projects and dance initiatives. A trend across both spectrums of his giving is his personal desire to create change (“I am a basic social activist”) rather than amass clout, which he is broadly recognized for among Democratic power players.

Wealth Accumulation: Union Square Ventures

Industry: Venture Capital

Foundation:

Website: http://avc.com

Wilson is a strong advocate of “philanthrocapitalism”, having led panels on the public service potential of private capital. He’s also written several blogs related to philanthropy, such as one on markets and philanthropy, and another asking if crowdfunding could be more patient than traditional venture capital, particularly when it comes to funding for charitable causes. Fred has also let it be known that the money he makes from his blog (AVC) is donated to charity, (around $25,000-$30,000) but didn’t say where it went, which seems to be typical of his approach to philanthropy: he’ll occasionally advocate for a cause and use his substantial network to do some fundraising, but the details of his own personal contributions usually remain private. Wilson’s primary areas of giving include Education, Net Neutrality and the NYC community.

Areas of Activity N/A

Wealth Accumulation: Lucasfilm

Industry: Film

Foundation: George Lucas Educational Foundation

Website: http://www.edutopia.org/

As George transitions from his career in Hollywood to devoting his time to philanthropic causes, education remains his number one priority, calling it “the key to the survival of the human race.” The majority of George’s assets are housed under The George Lucas Foundation; however, it serves as the parent organization underwriting both the George Lucas Educational Foundation and Edutopia. While focused almost entirely on K-12 education reform, George has also donated large sums to the University of California to expand its film school and has pledged significant resources to the Lucas Museum of Narrative Art, which is slated for a 2018 opening in Chicago.

Wealth Accumulation: Starbucks

Industry: Restaurants

Foundation: Schultz Family Foundation

Website: http://schultzfamilyfoundation.org/

Howard Schultz and his wife, Sheri, signaled they are gearing up their philanthropy by hiring Daniel Pitasky, a Gates foundation veteran, in October 2013 to run their family foundation. Mr. Pitasky, the grant maker’s fist executive director, will be working to expand the organization’s efforts. Since his hiring, the foundation launched two notable programs - Onward Veterans (with a $30,000,000 investment) and Onward Youth. Prior to hiring Pitasky, Schultz’s foundation gave piecemeal grants of a few hundred or a few thousand dollars to a wide range of community, educational, and Jewish organizations, many of them based in Seattle. Among organizations the Schultz foundation has supported in the past: Jewish Family Service in Seattle, the Robin Hood Foundation, and YouthCare, a Seattle nonprofit helping homeless youth.

Wealth Accumulation: eBay

Industry: E-Commerce

Foundation: The Skoll Foundation

Website: http://www.skollfoundation.org

Skoll is a highly innovative founder, but takes on only a small number of new grantees (or investments) each year. One big focus of his climate funding lately is improving climate advocacy through better sharing of information and learning. The Skoll Foundation is a model of philanthrocapitalism, i.e., harnessing business savvy to improve societal and environmental well-being, and not just to accrue capital. Skoll calls it social entrepreneurship: driving large-scale change by using innovation to disrupt the status quo. One of the things that distinguished Skoll from most other foundations was that he focused on finding good people and betting on them, rather than focusing on particular issues or program areas. Over time, he has refined this approach, creating a grid of the issues in the world that Skoll feels are most important.

Wealth Accumulation: Founder, Centaurus Advisors

Industry:

Foundation: The Laura and John Arnold Foundation

Website: http://arnoldfoundation.org/

Wealth Accumulation: Passport Capital, LLC

Industry: Finance

Foundation: Passport Foundation

Website:

John does not appear to be an active philanthropist. His major donation over the past two years consisted of a $750,000 contribution to Americans Elect.

$50 - $100 Million (Wealth Engine estimate)

Estimated Individual Candidate and/or PAC Giving (2014): $807,750, of which $750,000 was to Americans Elect

Wealth Accumulation: Tiger Management

Industry:

Foundation: Robertson Foundation

Website:

Wealth Accumulation: Oracle

Industry: Technology

Foundation: The Lawrence Ellison Foundation

Website: http://www.ellisonfoundation.org/

While having reportedly donated one percent of his personal wealth to charitable causes, The New York Times described him as the “biggest surprise” among the 40 other billionaires who committed to The Giving Pledge in 2010. For years, he had quietly given hundreds of millions of dollars to medical research. The relative low visibility of his initial giving reflected his belief that charitable giving is a “personal and private matter.” This was later criticized when he withdrew his $115 million pledge to Harvard University following the departure of former president Lawrence Summers. Over the years, his philanthropic giving has since broadened to support education, global health and development, and wildlife conservation, among other causes, albeit the causes still appear to be personal and at times rather spontaneous.

Wealth Accumulation: Inhereted; Apple

Industry:

Foundation: Emerson Collective; College Track

Website:

Wealth Accumulation: Apollo Global Management

Industry:

Foundation: Leon Black Family Foundation

Website:

• The arts have always been the Black’s biggest passion; however, their biggest gifts are not channeled through their foundation. Instead, as evidenced by their $48 million gift to Dartmouth, their major contributions are given directly to the source. • The scope of their philanthropic giving expanded following Deborah’s melanoma diagnosis. Since the diagnosis, the couple founded and continues to fund the Melanoma Research Alliance. • Describing the Alliance as their “newest biggest passion,” the couple does not hesitate to describe themselves as venture philanthropists, often times requiring stringent timelines for scientific research proposals.

Wealth Accumulation: Inhereted; Estee Lauder

Industry:

Foundation: The Leonard and Evelyn Lauder Foundation

Website:

Jewish agencies & synagogues

Wealth Accumulation: Moore Capital Management, LP

Industry:

Foundation: The Moore Charitable Foundation

Website: moorecharitable.org

Inconsistency between one pager, which lists donation areas as Vermont, New York and DC, and master list, which cites North Carolina and Bahamas as additional areas of interest.

Wealth Accumulation: Mosaic; Netscape Communications Corporation

Industry:

Foundation: Marc and Laura Andreessen Foundation

Website:

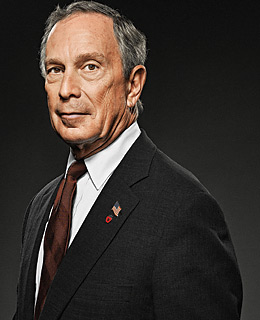

Wealth Accumulation:

Industry:

Foundation: Bloomberg Philanthropies

Website: bloomberg.org

Donates to "Founders Projects (John Hopkins, Women for Women)

Wealth Accumulation: Microsoft

Industry:

Foundation: Paul G. Allen Family Foundation

Website:

Wealth Accumulation: Elliott Management

Industry: Finance

Foundation: The Paul E. Singer Foundation

Website: http://www.americanunitypac.com/

The Paul E. Singer Foundation takes a targeted, results-oriented approach to philanthropy, seeking measurable outcomes of its work in the medium to long term. Whenever possible, Singer’s Foundation seeks to leverage its own philanthropic investments by partnering with proven non-profits and like-minded founders. Singer, who has a gay son, turned his attention toward gay-rights issues more than a decade ago and has been giving generously to various gay-rights initiatives since. Marriage equality, Singer has said, is an issue that doesn't or at least shouldn't fit into any tidy partisan box: it crosses all sorts of lines. After all, gay and lesbian people can be present in any family, any community.

Wealth Accumulation: Tudor Investment Corporation

Industry: Finance

Foundation: Robin Hood Foundation

Website: https://www.robinhood.org

The Robin Hood Foundation practices a “venture philanthropy” philosophy, in that cash is solicited and then deployed in a quantitative, results-based manner. Due diligence and attentive monitoring is a prerequisite for every investment. If expectations are not met, funding is discontinued. In essence, the foundation’s operations mirror that of Paul’s hedge fund. At the end of 2013, the foundation primarily focus shifted to reforming the public education system, aiming to leverage its influence to effect public policy. Paul, who has historically been media adverse, has recently acknowledged the importance of stepping into the spotlight to influence and engage all key stakeholder groups on the issue.

Wealth Accumulation: PayPal; Facebook (Early Investor)

Industry: Venture Capital

Foundation: The Thiel Foundation

Website: http://www.thielfoundation.org

The Thiel Foundation has a limited number of projects that work to advance Peter Thiel’s unconventional vision. It funds anti-aging research, and created and is the primary founder of the Seasteading Institute, which seeks to build independent city-states in the ocean. Thiel’s contrarianism is notorious, and he appears to delight in saying or doing the unexpected, even at the risk of ridicule. Thiel believes he supports the free enterprise system by helping people become entrepreneurs. In support of this vision, the Thiel Foundation gives a handful of college students $100,000 each year to drop out of school and pursue risky startups. This program, dubbed “20 under 20”, is in contrast to the large number of foundations who insist that giving heavily credentialed people late in their careers large sums is the right way to give.

Wealth Accumulation: eBay

Industry: E-Commerce

Foundation: Omidyar Network

Website: http://omidyar.com/

Recognized as one of the fist to adopt a venture capital approach to philanthropy, the Omidyars have been philanthropic innovators and powerful advocates for a variety of causes. Distinguishing between charity and philanthropy, they focus on developing philanthropic teams that can create long-term transformational change. Unlike other philanthropist who funnel their money through a single family foundation, the Omidyars have pursued their philanthropic missions through three different major charitable organizations: the Omidyar Network Fund, HopeLabs, and Humanity United. The aversion to a single centralized philanthropic entity reflects their emphasis on the need to remain flexible and dynamic, and to adapt constantly.

**************Previous data for description***************

Pierre Morad Omidyar (June 21, 1967) is a French-Iranian-American entrepreneur and philanthropist, who is the founder and chairman of the eBay auction site. He became a billionaire at the age of 31 with eBay's 1998 Initial Public Offering (IPO). Omidyar and his wife Pamela are well-known philanthropists who founded Omidyar Network in 2004 in order to expand their efforts beyond nonprofits to include for-profits and public policy. Since 2010 Omidyar has been involved in online journalism as head of investigative reporting and public affairs news service Honolulu Civil Beat. In 2013, he announced he would be creating and financing First Look Media, a journalism venture to include Glenn Greenwald, Laura Poitras, and Jeremy Scahill.(from Wikipedia)

**************************************************************

Wealth Accumulation: Virgin

Industry:

Foundation: Virgin Unite

Website:

Richard’s philanthropic initiatives are extensive. He devotes upwards of 80 percent of his time to Virgin Unite, his nonprofit foundation that aims to tackle tough social and environmental problems in an “entrepreneurial way.” Richard believes that the only way to address the scale of the challenges facing the world today is through facilitating new ways for businesses, governments and the social sector to work together. Richard’s initiatives are wide ranging from creating sustainable healthcare models in Africa to supporting young entrepreneurs through the Branson School of Entrepreneurship in South Africa and Jamaica, to creating opportunities for disadvantaged young people in the United States and the United Kingdom.

£17,456,000 The amount reflected in the Foundations Assets field is in British pounds

Areas of Activity N/A

Wealth Accumulation: Napster; Facebook

Industry:

Foundation: Sean N. Parker Foundation

Website:

Sean describes himself as "very strange philanthropist" in that he doesn't follow the traditional model of writing large, blanket checks. He is averse to working through the bureaucracy of a development office. Instead, Sean's giving approach is two-pronged: he supports center-leaning political candidates who have shown willingness to work across the aisle and, by his estimate, has directed about $20 million in grants to support cancer immunotherapy research. Sean is a canny contributor who demands a clear sense of how his money is spent. His medical grants are conditional.

Historically a Democrat, although supported moderate Republicans in the 2014 midterm cycle

PAC contribution of $1,460,000 is for 2014 cycle. It represents 16 times his giving in 2012.

Wealth Accumulation: Baupost Group

Industry: Finance

Foundation: The Klarman Family Foundation

Website: http://klarmanfoundation.org/

For their charitable giving, the Klarmans have three chosen areas of focus: civic and community (most notably music education), scientific and medical research (particularly in the area of behavioral health) and Jewish causes (including support for the State of Israel). In his letter to The Giving Pledge, Seth noted that society’s problems appear to compound faster than his wealth accumulation, implying his recognition of the limitations of his philanthropy and conveying his importance of targeting only the areas where he thinks he can maximize his giving’s impact.

Local access to music

Wealth Accumulation:

Industry:

Foundation: Charles and Lynn Schusterman Family Foundation

Website: http://www.schusterman.org/

The Schustermans’ charitable giving largely has been directed at Jewish organizations or those that support Israel and Israeli identity. Stacy Schusterman is known in Tulsa as an intensely private person, devoted to creating a down-to-earth environment to raise her three children and shunning the spotlight while using her personal wealth to support causes in education, the arts and the Jewish community. Schusterman sits on the boards of the American Israel Public Affairs Committee, Hillel and BBYO, a group that that sponsors Birthright Israel trips for young people.

Wealth Accumulation:

Industry:

Foundation: The Druckenmiller Foundation

Website:

When discussing his investment philosophy, Druckenmiller has said, “The dirtiest word in investing is diversification. I always found you make most of your money with two or three ideas a year.” When it comes to philanthropy, Druckenmiller appears to have the same basic philosophy, giving the vast majority of his philanthropic dollars to just a few organizations. He has however made a number of smaller contributions to organizations that are still significant. “I like putting all my eggs in one basket and then watching that basket carefully,” says Druckenmiller of his strategy for both business and philanthropy. Druckenmiller’s funding areas include: Health, Education, Environment, Arts and Community Development.

Wealth Accumulation: Microsoft

Industry: Technology

Foundation:

Website:

The scale of the Ballmer’s philanthropy increased dramatically in November 2014 when the couple announced major donations to their alma maters ($50 million to Oregon and $60 million to Harvard). Described as “analytical to a fault,” Ballmer is crafting his philanthropic giving plan with what his wife describes as an “economist’s precision” -- looking for gaps in the current system as well as ensuring he avoids any irreversible steps of committing a sizable portion of his fortune into a foundation. While his grand philanthropic vision is still undetermined, he has waved off the notion of following Warren Buffett’s example and passively submitting his wealth to the Bill and Melinda Gates Foundation to manage. He intends to chart his own path.

Wealth Accumulation: SAC Capital Advisors, L.P.

Industry:

Foundation: Steven & Alexandra Cohen Foundation

Website: http://www.steveandalex.org/

Given SAC Capital Advisor's guilty plea with the Southern District of New York, the scope of Steve's future philanthropic initiatives remains uncertain. Prior to the settlement, Steve expressed an increasing interest in politics as "a way to express a view of what needs to be done in the country;" however, his political giving has been relatively non-existent over the past two years. Steve maintains that his charitable giving will only continue to increase. With this in mind, his wife, Alexandra, is widely considered the "central" figure in guiding their foundation's grantmaking, which focuses on three primarily areas: military veterans, children's hospitals and education.

Party Affiliation:

Steve hosted fundraisers for the Republican Party in 2012; however, he has never publically stated his political leaning.

Areas of activity added by Brian MacMillan based on content of website.

Wealth Accumulation: Farallon Capital

Industry:

Foundation:

Website:

Steyer is a huge proponent of alternative energy, as well as a strong believer in philanthrocapitalism. He directs his giving toward projects and institutions that promote environmental sustainability, and are also working toward commercial viability, primarily funding research and policy centers at the universities, and engaging in political advocacy. “I don’t really consider [what I do] philanthropy,” says Tom Steyer. Instead, he thrills at the challenge of overcoming obstacles to accomplish the things he thinks are important. Community banking is one of three causes – “good food, good banking, and good energy,” – that anchors Steyer’s philanthropy in order to narrow the rich-poor divide and address the “moral blind spots” of our generation.

Wealth Accumulation: Quark

Industry:

Foundation: The Gill Foundation

Website:

Wealth Accumulation:

Industry:

Foundation: The Draper Foundation

Website: BizWorld.org; Draper University

Draper appears to focus his philanthropic activities - including funding the BizWorld Foundation -through The Draper Foundation. The BizWorld Foundation’s mission is to challenge and engage children across the cultural and economic spectrum through experiential learning programs that teach the basics of business, entrepreneurship, and money management and promote teamwork and leadership in the classroom. In early 2014, Draper filed a petition to divide California into six smaller states, arguing that California is “increasingly ungovernable” as one state. Despite his own claims that he spent “as little as possible” to advance this idea, it’s reported that he spent millions of his own capital in attempt to spur political reform in the state. The initiative faced backlash and ultimately failed.

Wealth Accumulation: Paychex

Industry:

Foundation: Golisano Foundation

Website:

Wealth Accumulation: Schooner Capital LLC

Industry:

Foundation:

Website:

Wealth Accumulation:

Industry:

Foundation: Draper Richards Kaplan Foundation

Website: Draper Richards Kaplan Foundation

The stated goal of Draper’s foundation is ostensibly methodical with parallels to early stage investing in venture capital, attempting to “find social entrepreneurs with dynamic ideas and nurture them at the early stages with maximum leverage and total commitment.” Compared to other Impact Investors, Draper’s approach is materially different, providing “unrelenting on-going support” to his grantees. The foundation goes so far as to take a board seat for three years, often serving an organization’s first outside board member. Draper attributes much of the model’s success to his staff and the individuals he backs. “Just like in venture capital, the entrepreneur is the one who’s the hero,” Draper said. “But in the nonprofit world we have a greater success rate than in the venture capital world because the leaders are so determined."

Wealth Accumulation: Inherited; Ford Motor Co.

Industry:

Foundation:

Website:

- Close

- Investor Details

- Arnold

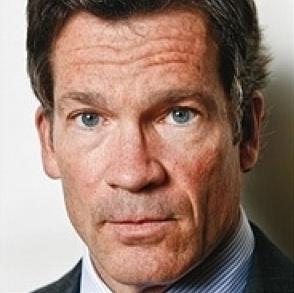

- Blank

- Eychaner

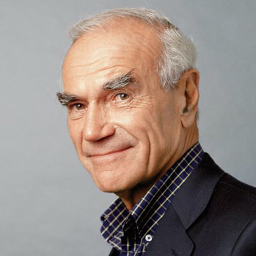

- Munger

- Hughes

- Lucas

- Schultz

- Skoll

- Walton